Understanding annualized return

S

Steve08 марта 25 г. | Posted in general

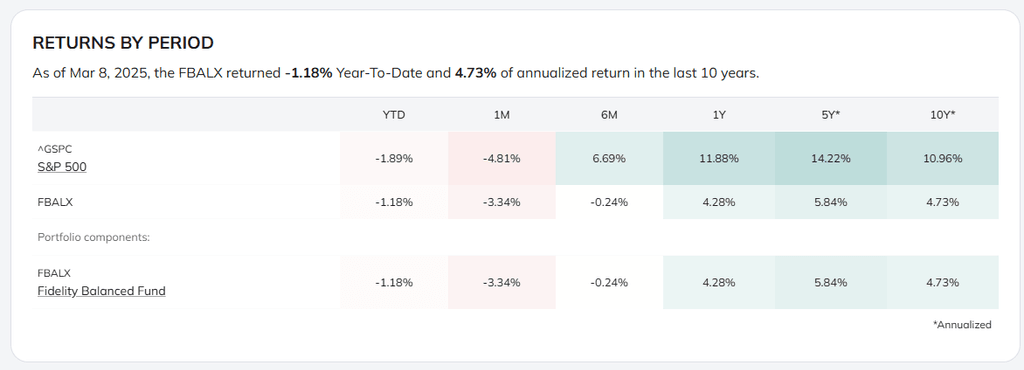

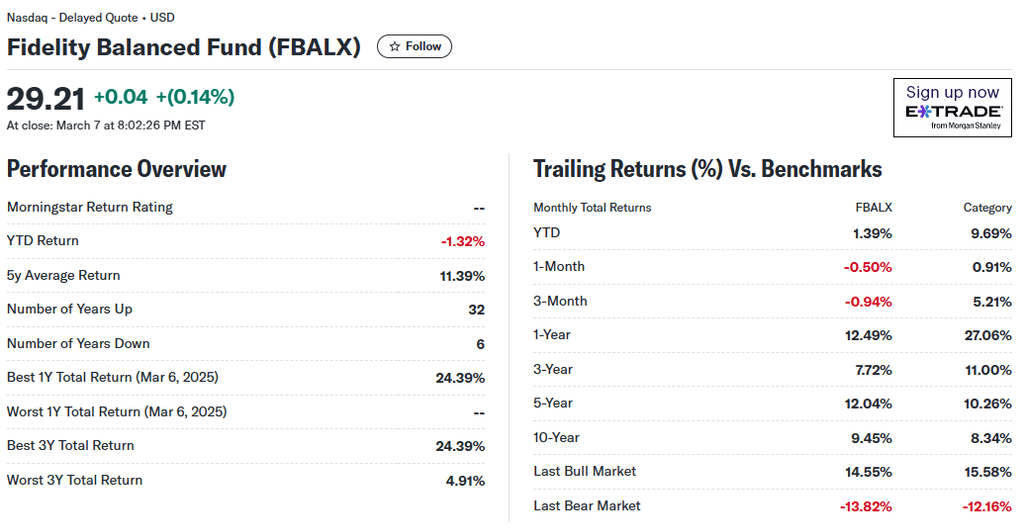

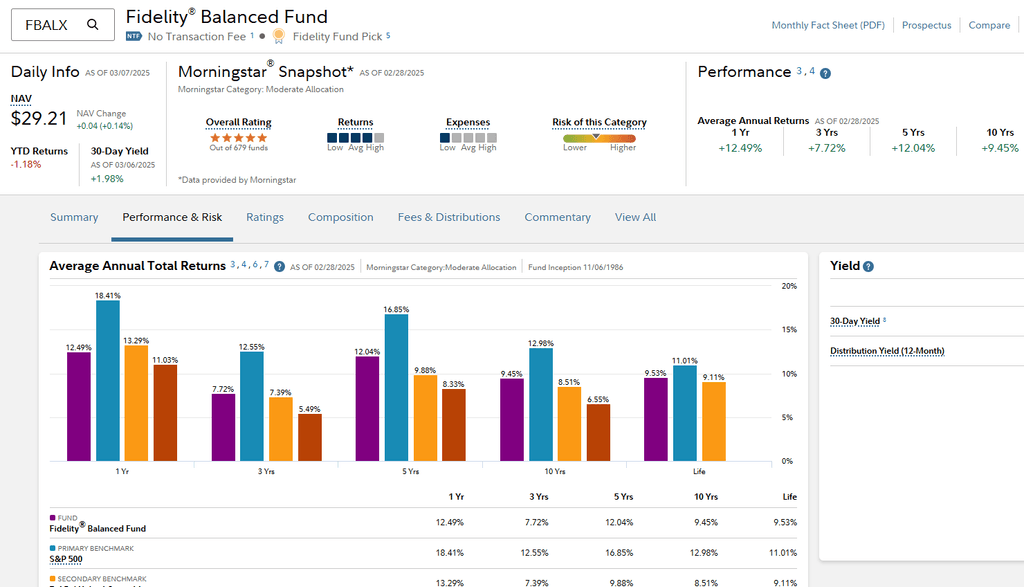

I'm trying to understand the difference between the annualized 10-yr return of FBALX reported here at 4.73% vs other sites at 9.45%.

Screenshots from PortfoliosLab, Yahoo Finance, and Fidelity below.

What am I missing? Thanks in advance.

https://portfolioslab.com/portfolio/gaftrwmj24whdrduj87s4xge

https://finance.yahoo.com/quote/FBALX/performance/

https://fundresearch.fidelity.com/mutual-funds/performance-and-risk/316345206

2 комментария

Сортировать по

Самые старые

DS

Dmitry Shevchenko19 мая 25 г.

Unfortunately, capital gains data for some funds is missing from our data provider. This appears to be a common issue, we evaluated several other data sources and couldn't find one that has complete information either. We've asked our provider to include this data so total returns can be properly calculated, but we don’t have an ETA on when this will be resolved.

Категория

Общая

Просмотры

74