Aris Water Solutions, Inc. (ARIS)

Company Info

US04041L1061

04041L106

Oct 22, 2021

Highlights

$1.40B

$0.85

28.62

$452.53M

$184.10M

$137.51M

$13.14 - $33.95

$30.75

9.05%

3.66

Share Price Chart

Compare to other instruments

Search for stocks, ETFs, and funds for a quick comparison or use the comparison tool for more options.

Performance

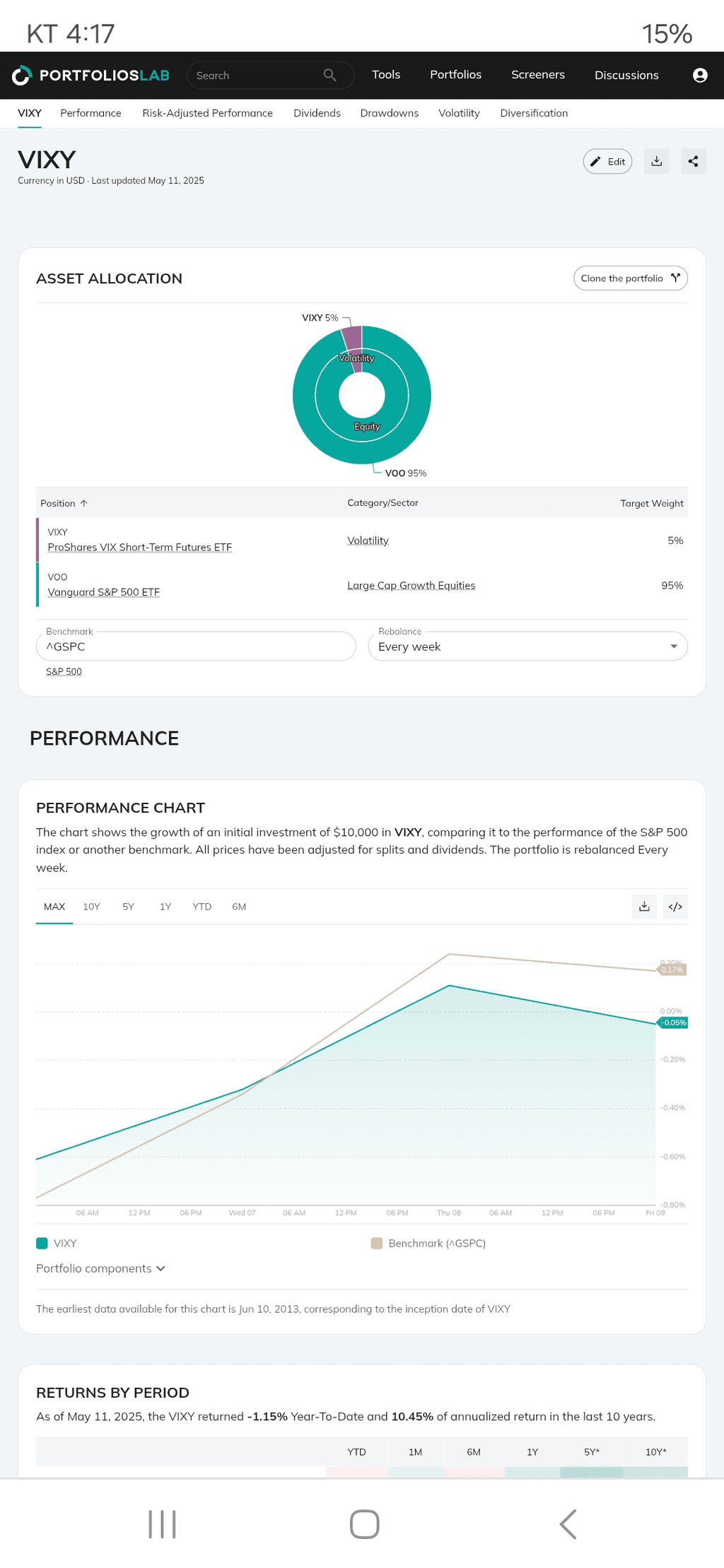

Performance Chart

The chart shows the growth of an initial investment of $10,000 in Aris Water Solutions, Inc., comparing it to the performance of the S&P 500 index or another benchmark. All prices have been adjusted for splits and dividends.

Returns By Period

Aris Water Solutions, Inc. (ARIS) returned -0.79% year-to-date (YTD) and 44.79% over the past 12 months.

ARIS

-0.79%

-3.23%

-2.67%

44.79%

N/A

N/A

^GSPC (Benchmark)

0.19%

9.00%

-1.55%

12.31%

15.59%

10.78%

Monthly Returns

The table below presents the monthly returns of ARIS, with color gradation from worst to best to easily spot seasonal factors. Returns are adjusted for dividends.

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 6.60% | 23.23% | 2.32% | -22.10% | -6.61% | -2.21% | |||||||

| 2024 | 3.69% | 38.39% | 18.43% | -0.85% | 9.55% | 2.66% | 13.02% | -5.03% | 0.95% | -2.19% | 63.03% | -10.61% | 192.72% |

| 2023 | 7.49% | -8.59% | -44.40% | -6.68% | 26.41% | 13.41% | 5.91% | -6.31% | -1.66% | -16.33% | -3.23% | 5.05% | -39.34% |

| 2022 | -10.18% | 26.27% | 25.24% | -6.92% | 21.21% | -18.36% | 26.92% | -19.29% | -24.94% | 33.46% | -6.62% | -8.91% | 14.20% |

| 2021 | -4.41% | 6.07% | -10.69% | -9.44% |

Risk-Adjusted Performance

Risk-Adjusted Performance Rank

With an overall rank of 78, ARIS is among the top 22% of stocks on our website when it comes to balancing risk and reward. Below is a breakdown of how it compares using common performance measures.

Risk-Adjusted Performance Indicators

The charts below present risk-adjusted performance metrics for Aris Water Solutions, Inc. (ARIS) and compare them to a chosen benchmark (^GSPC). These indicators evaluate an investment's returns against its associated risks.

Dividends

Dividend History

Aris Water Solutions, Inc. provided a 1.95% dividend yield over the last twelve months, with an annual payout of $0.46 per share.

| Period | TTM | 2024 | 2023 | 2022 |

|---|---|---|---|---|

| Dividend | $0.46 | $0.41 | $0.36 | $0.43 |

Dividend yield | 1.95% | 1.69% | 4.29% | 2.98% |

Monthly Dividends

The table displays the monthly dividend distributions for Aris Water Solutions, Inc.. The dividends shown in the table have been adjusted to account for any splits that may have occurred.

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | $0.00 | $0.00 | $0.14 | $0.00 | $0.00 | $0.14 | |||||||

| 2024 | $0.00 | $0.00 | $0.09 | $0.00 | $0.00 | $0.11 | $0.00 | $0.00 | $0.11 | $0.00 | $0.00 | $0.11 | $0.41 |

| 2023 | $0.00 | $0.00 | $0.09 | $0.00 | $0.00 | $0.09 | $0.00 | $0.00 | $0.09 | $0.00 | $0.00 | $0.09 | $0.36 |

| 2022 | $0.07 | $0.00 | $0.09 | $0.00 | $0.09 | $0.00 | $0.00 | $0.09 | $0.00 | $0.00 | $0.09 | $0.00 | $0.43 |

Dividend Yield & Payout

Dividend Yield

Aris Water Solutions, Inc. has a dividend yield of 1.92%, which is quite average when compared to the overall market.

Payout Ratio

Aris Water Solutions, Inc. has a payout ratio of 38.58%, which is quite average when compared to the overall market. This suggests that Aris Water Solutions, Inc. strikes a balance between reinvesting profits for growth and paying dividends to shareholders.

Drawdowns

Drawdowns Chart

The Drawdowns chart displays portfolio losses from any high point along the way. Drawdowns are calculated considering price movements and all distributions paid, if any.

Worst Drawdowns

The table below displays the maximum drawdowns of the Aris Water Solutions, Inc.. A maximum drawdown is a measure of risk, indicating the largest reduction in portfolio value due to a series of losing trades.

The maximum drawdown for the Aris Water Solutions, Inc. was 69.64%, occurring on Apr 25, 2023. Recovery took 387 trading sessions.

The current Aris Water Solutions, Inc. drawdown is 29.47%.

Depth | Start | To Bottom | Bottom | To Recover | End | Total |

|---|---|---|---|---|---|---|

| -69.64% | Aug 3, 2022 | 183 | Apr 25, 2023 | 387 | Nov 6, 2024 | 570 |

| -40.44% | Apr 3, 2025 | 24 | May 7, 2025 | — | — | — |

| -27.87% | Nov 10, 2021 | 28 | Dec 20, 2021 | 47 | Feb 28, 2022 | 75 |

| -25.09% | Jun 10, 2022 | 21 | Jul 12, 2022 | 11 | Jul 27, 2022 | 32 |

| -19.62% | Apr 18, 2022 | 16 | May 9, 2022 | 10 | May 23, 2022 | 26 |

Volatility

Volatility Chart

The current Aris Water Solutions, Inc. volatility is 30.53%, representing the average percentage change in the investments's value, either up or down over the past month. The chart below shows the rolling one-month volatility.

Financials

Financial Performance

The chart below illustrates the trends in the financial health of Aris Water Solutions, Inc. over time, highlighting three key metrics: Total Revenue, Earnings Before Interest and Taxes (EBIT), and Net Income.

Earnings Per Share

The chart presents the Earnings Per Share (EPS) performance of Aris Water Solutions, Inc., comparing actual results with analytics estimates. The company has exceeded analyst expectations for EPS in the past quarter, achieving a 24.0% positive surprise.

Valuation

The Valuation section provides an overview of how Aris Water Solutions, Inc. is priced in the market compared to other companies in the Utilities - Regulated Water industry. It includes key financial ratios that help investors assess whether the stock is undervalued or overvalued.

PE Ratio

The chart displays the Price-to-Earnings (P/E) ratio for ARIS, comparing it with other companies in the Utilities - Regulated Water industry. Currently, ARIS has a P/E ratio of 28.6. This P/E ratio is significantly higher than those of industry peers. This could indicate that the stock is overvalued or that investors expect strong future growth.

PS Ratio

This chart shows the Price-to-Sales (P/S) ratio for ARIS relative to other companies in the Utilities - Regulated Water industry. Currently, ARIS has a P/S ratio of 3.1. This P/S ratio falls within the average range for the industry, suggesting the stock is fairly valued based on its revenue.

PB Ratio

The chart illustrates the Price-to-Book (P/B) ratio for ARIS in comparison with other companies in the Utilities - Regulated Water industry. Currently, ARIS has a P/B value of 1.9. This P/B ratio is in line with the industry average, suggesting the stock is valued fairly in relation to its book value.

Historical P/E Ratio Chart

The chart below displays the historical trend of the price-to-earnings (P/E) ratio for Aris Water Solutions, Inc..

Income Statement

| TTM | |

|---|---|

Revenue | — |

Total Revenue | — |

Cost Of Revenue | — |

Gross Profit | — |

Operating Expenses | — |

Selling, General & Admin Expenses | — |

R&D Expenses | — |

Depreciation And Amortization | — |

Total Operating Expenses | — |

Income | — |

Income Before Tax | — |

Operating Income | — |

EBITDA | — |

EBIT | — |

Earnings From Continuing Operations | — |

Net Income | — |

Income Tax Expense | — |

Other Non-Operating Income (Expenses) | — |

Extraordinary Items | — |

Discontinued Operations | — |

Effect Of Accounting Charges | — |

Non Recurring | — |

Minority Interest | — |

Other Items | — |

Interest Income | — |

Interest Expense | — |

Net Interest Income | — |

User Portfolios with ARIS

-2%

YTD

People also watch

Recent discussions

Why did my stock chart get weird?

Obviously, even though

I set the section of the chart to MAX,

only very limited sections of the chart appear.

What's the problem? I think it's a problem

with my plan, so I upgraded it to PLUS,

but there's no change.

늑대콘

Discrepancy between SPY and ^GSPC?

Hello, from the charts, SPY seems to be outperforming its benchmark ^GSPC. That looks strange. From my understanding, SPY is designed to closely track the S&P 500.

Could there be an error in the charts?

Hedge Cat

Treynor Black model

guphex