сортино 10+

Asset Allocation

| Position | Category/Sector | Target Weight |

|---|---|---|

1YD.DE Broadcom Inc | Technology | 1% |

AGZD WisdomTree Interest Rate Hedged U.S. Aggregate Bond Fund | Total Bond Market | 21% |

BEL.NS Bharat Electronics Limited | Industrials | 8% |

BTC-USD Bitcoin | 6% | |

HFSAX Hundredfold Select Alternative Fund Investor Class | Tactical Allocation | 7% |

NVDA NVIDIA Corporation | Technology | 3% |

OSX2.DE Ossiam US Minimum Variance ESG UCITS ETF (EUR) | Large Cap Value Equities | 12% |

QLEIX AQR Long-Short Equity Fund | Long-Short | 5% |

SGLN.L iShares Physical Gold ETC | Precious Metals, Commodities | 1% |

SVARX Spectrum Low Volatility Fund | Nontraditional Bonds | 33% |

TITAN.NS Titan Company Limited | Consumer Cyclical | 3% |

Performance

Performance Chart

Loading data...

The earliest data available for this chart is Dec 18, 2013, corresponding to the inception date of AGZD

Returns By Period

As of May 29, 2025, the сортино 10+ returned 6.56% Year-To-Date and 17.58% of annualized return in the last 10 years.

| YTD | 1M | 6M | 1Y | 5Y* | 10Y* | |

|---|---|---|---|---|---|---|

^GSPC S&P 500 | 0.12% | 6.51% | -1.84% | 10.98% | 14.10% | 10.82% |

| сортино 10+ | 6.56% | 5.30% | 5.31% | 13.95% | 20.30% | 17.58% |

| Portfolio components: | ||||||

BTC-USD Bitcoin | 16.66% | 14.76% | 13.58% | 59.59% | 63.12% | 85.15% |

HFSAX Hundredfold Select Alternative Fund Investor Class | 2.67% | 1.72% | 1.25% | 6.75% | 7.87% | 7.55% |

AGZD WisdomTree Interest Rate Hedged U.S. Aggregate Bond Fund | 0.97% | 0.59% | 1.72% | 4.81% | 3.74% | 2.59% |

TITAN.NS Titan Company Limited | 9.88% | 6.10% | 6.77% | 2.56% | 29.42% | 22.12% |

NVDA NVIDIA Corporation | 0.40% | 23.99% | -0.38% | 18.40% | 72.44% | 73.82% |

SVARX Spectrum Low Volatility Fund | 1.31% | 0.55% | 0.08% | 3.41% | 4.59% | 5.40% |

1YD.DE Broadcom Inc | -0.74% | 23.97% | 48.56% | 68.83% | 56.51% | 33.84% |

BEL.NS Bharat Electronics Limited | 33.93% | 28.00% | 25.59% | 32.77% | 75.13% | 25.50% |

OSX2.DE Ossiam US Minimum Variance ESG UCITS ETF (EUR) | 2.59% | 2.14% | -2.06% | 11.16% | 7.76% | 6.96% |

QLEIX AQR Long-Short Equity Fund | 14.92% | 4.60% | 17.09% | 23.86% | 24.99% | 11.63% |

SGLN.L iShares Physical Gold ETC | 26.16% | -1.63% | 24.35% | 39.40% | 13.51% | 10.48% |

Monthly Returns

The table below presents the monthly returns of сортино 10+, with color gradation from worst to best to easily spot seasonal factors. Returns are adjusted for dividends.

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2025 | 1.33% | -2.14% | 0.84% | 1.50% | 4.99% | 6.56% | |||||||

| 2024 | 1.44% | 5.17% | 3.17% | -0.46% | 3.97% | 1.47% | 0.99% | 0.28% | 1.37% | -0.21% | 4.46% | -1.39% | 21.98% |

| 2023 | 4.76% | -0.57% | 3.35% | 0.93% | 0.94% | 3.95% | 1.30% | 0.03% | -0.34% | 1.24% | 4.66% | 5.89% | 29.17% |

| 2022 | -2.07% | 0.20% | 1.29% | -1.98% | -1.19% | -4.35% | 4.41% | -1.24% | -2.55% | 2.23% | 1.71% | -1.71% | -5.43% |

| 2021 | 1.78% | 3.42% | 3.63% | 1.48% | 0.40% | 2.71% | 1.66% | 1.96% | -0.34% | 4.05% | -0.02% | 0.02% | 22.68% |

| 2020 | 1.75% | -2.58% | -5.41% | 4.84% | 2.57% | 3.90% | 5.75% | 3.84% | -1.95% | 0.09% | 7.45% | 7.50% | 30.41% |

| 2019 | 1.84% | 2.05% | 2.99% | 2.24% | 4.89% | 6.49% | -0.92% | -0.43% | 0.51% | 2.11% | -2.77% | 1.20% | 21.76% |

| 2018 | -0.78% | -1.98% | -2.13% | 1.55% | -2.67% | -1.82% | 2.84% | -0.49% | -2.78% | -1.34% | -2.46% | -1.27% | -12.68% |

| 2017 | 2.15% | 3.25% | 0.57% | 3.68% | 6.67% | 0.97% | 3.19% | 5.83% | -1.39% | 5.57% | 5.81% | 4.20% | 48.47% |

| 2016 | -2.77% | -0.18% | 4.35% | 1.44% | 2.78% | 2.97% | 1.57% | 0.54% | 0.69% | 1.18% | 2.05% | 3.05% | 18.98% |

| 2015 | -0.08% | 3.96% | -2.20% | -1.05% | 1.55% | -0.82% | 1.71% | -3.62% | 0.16% | 4.68% | 1.63% | 2.22% | 8.09% |

| 2014 | -0.89% | 0.04% | 2.07% | 0.59% | 6.86% | 4.24% | -2.64% | 1.28% | -1.64% | -0.09% | 2.44% | 1.25% | 13.97% |

Expense Ratio

сортино 10+ has a high expense ratio of 1.09%, indicating above-average management fees. Below, you can find the expense ratios of the portfolio's funds side by side and easily compare their relative costs.

Risk-Adjusted Performance

Risk-Adjusted Performance Rank

With an overall rank of 81, сортино 10+ is among the top 19% of portfolios on our website when it comes to balancing risk and reward. Below is a breakdown of how it compares using common performance measures.

Risk-Adjusted Performance Indicators

This table presents a comparison of risk-adjusted performance metrics for positions. Risk-adjusted metrics are performance indicators that assess an investment's returns in relation to its risk, enabling a more accurate comparison of different investment options.

| Sharpe ratio | Sortino ratio | Omega ratio | Calmar ratio | Martin ratio | |

|---|---|---|---|---|---|

BTC-USD Bitcoin | 1.20 | 3.11 | 1.33 | 2.42 | 11.47 |

HFSAX Hundredfold Select Alternative Fund Investor Class | 1.29 | 1.61 | 1.21 | 0.28 | 3.64 |

AGZD WisdomTree Interest Rate Hedged U.S. Aggregate Bond Fund | 1.04 | 1.40 | 1.17 | 0.38 | 7.75 |

TITAN.NS Titan Company Limited | 0.11 | -0.40 | 0.95 | 0.27 | -0.59 |

NVDA NVIDIA Corporation | 0.31 | 1.04 | 1.14 | 0.24 | 1.82 |

SVARX Spectrum Low Volatility Fund | 1.30 | -0.49 | 0.93 | 1.34 | -0.63 |

1YD.DE Broadcom Inc | 1.19 | 1.98 | 1.27 | 0.76 | 4.76 |

BEL.NS Bharat Electronics Limited | 0.80 | 2.15 | 1.25 | 0.74 | 5.36 |

OSX2.DE Ossiam US Minimum Variance ESG UCITS ETF (EUR) | 0.80 | 0.36 | 1.05 | 0.03 | 0.86 |

QLEIX AQR Long-Short Equity Fund | 2.47 | 4.20 | 1.72 | 1.71 | 24.10 |

SGLN.L iShares Physical Gold ETC | 2.16 | 2.87 | 1.39 | 2.01 | 13.25 |

Loading data...

Dividends

Dividend yield

сортино 10+ provided a 4.27% dividend yield over the last twelve months.

| TTM | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Portfolio | 4.27% | 4.76% | 3.89% | 3.02% | 3.22% | 3.21% | 2.91% | 2.07% | 4.17% | 4.05% | 1.84% | 2.44% |

| Portfolio components: | ||||||||||||

BTC-USD Bitcoin | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

HFSAX Hundredfold Select Alternative Fund Investor Class | 5.72% | 5.87% | 5.17% | 4.92% | 10.98% | 13.58% | 6.44% | 3.10% | 11.87% | 5.61% | 1.86% | 8.84% |

AGZD WisdomTree Interest Rate Hedged U.S. Aggregate Bond Fund | 4.19% | 3.96% | 6.07% | 8.61% | 1.66% | 2.28% | 2.83% | 2.62% | 2.35% | 1.81% | 1.66% | 1.69% |

TITAN.NS Titan Company Limited | 0.31% | 0.34% | 0.54% | 0.29% | 0.16% | 0.26% | 0.42% | 0.40% | 0.30% | 0.67% | 0.66% | 0.55% |

NVDA NVIDIA Corporation | 0.03% | 0.03% | 0.03% | 0.11% | 0.05% | 0.12% | 0.27% | 0.46% | 0.29% | 0.45% | 1.20% | 1.70% |

SVARX Spectrum Low Volatility Fund | 7.91% | 9.35% | 3.35% | 0.00% | 5.85% | 4.46% | 4.91% | 2.41% | 6.90% | 9.07% | 3.02% | 2.82% |

1YD.DE Broadcom Inc | 0.88% | 0.78% | 1.53% | 2.76% | 1.90% | 2.95% | 0.92% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

BEL.NS Bharat Electronics Limited | 0.59% | 0.75% | 0.98% | 1.50% | 1.91% | 2.33% | 2.70% | 2.27% | 1.12% | 1.24% | 0.71% | 0.79% |

OSX2.DE Ossiam US Minimum Variance ESG UCITS ETF (EUR) | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

QLEIX AQR Long-Short Equity Fund | 6.20% | 7.12% | 20.80% | 14.15% | 0.00% | 1.57% | 0.00% | 6.03% | 9.12% | 3.01% | 4.98% | 8.00% |

SGLN.L iShares Physical Gold ETC | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

Drawdowns

Drawdowns Chart

The Drawdowns chart displays portfolio losses from any high point along the way. Drawdowns are calculated considering price movements and all distributions paid, if any.

Loading data...

Worst Drawdowns

The table below displays the maximum drawdowns of the сортино 10+. A maximum drawdown is a measure of risk, indicating the largest reduction in portfolio value due to a series of losing trades.

The maximum drawdown for the сортино 10+ was 19.61%, occurring on Dec 10, 2018. Recovery took 198 trading sessions.

Depth | Start | To Bottom | Bottom | To Recover | End | Total |

|---|---|---|---|---|---|---|

| -19.61% | Dec 17, 2017 | 359 | Dec 10, 2018 | 198 | Jun 26, 2019 | 557 |

| -14.84% | Feb 24, 2020 | 29 | Mar 23, 2020 | 74 | Jun 5, 2020 | 103 |

| -10.79% | Nov 15, 2021 | 233 | Jul 5, 2022 | 280 | Apr 11, 2023 | 513 |

| -6.46% | Mar 2, 2015 | 176 | Aug 24, 2015 | 67 | Oct 30, 2015 | 243 |

| -6.15% | Dec 17, 2024 | 112 | Apr 7, 2025 | 35 | May 12, 2025 | 147 |

Volatility

Volatility Chart

The chart below shows the rolling one-month volatility.

Loading data...

Diversification

Diversification Metrics

Number of Effective Assets

The portfolio contains 11 assets, with an effective number of assets of 5.35, reflecting the diversification based on asset allocation. This number of effective assets indicates a moderate level of diversification, where some assets may have a more significant influence on overall performance.

Asset Correlations Table

| ^GSPC | SGLN.L | AGZD | BTC-USD | TITAN.NS | BEL.NS | OSX2.DE | QLEIX | 1YD.DE | NVDA | SVARX | HFSAX | Portfolio | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ^GSPC | 1.00 | 0.02 | 0.11 | 0.16 | 0.14 | 0.14 | 0.36 | 0.50 | 0.35 | 0.63 | 0.41 | 0.70 | 0.51 |

| SGLN.L | 0.02 | 1.00 | -0.06 | 0.07 | 0.04 | 0.05 | -0.04 | -0.02 | -0.03 | 0.01 | 0.14 | 0.13 | 0.08 |

| AGZD | 0.11 | -0.06 | 1.00 | 0.01 | 0.07 | 0.05 | 0.10 | 0.10 | 0.07 | 0.06 | 0.08 | 0.07 | 0.17 |

| BTC-USD | 0.16 | 0.07 | 0.01 | 1.00 | 0.02 | -0.00 | 0.02 | 0.03 | 0.04 | 0.12 | 0.06 | 0.13 | 0.62 |

| TITAN.NS | 0.14 | 0.04 | 0.07 | 0.02 | 1.00 | 0.30 | 0.13 | 0.08 | 0.10 | 0.08 | 0.13 | 0.14 | 0.31 |

| BEL.NS | 0.14 | 0.05 | 0.05 | -0.00 | 0.30 | 1.00 | 0.09 | 0.09 | 0.12 | 0.07 | 0.14 | 0.15 | 0.48 |

| OSX2.DE | 0.36 | -0.04 | 0.10 | 0.02 | 0.13 | 0.09 | 1.00 | 0.22 | 0.31 | 0.14 | 0.19 | 0.26 | 0.35 |

| QLEIX | 0.50 | -0.02 | 0.10 | 0.03 | 0.08 | 0.09 | 0.22 | 1.00 | 0.16 | 0.25 | 0.17 | 0.34 | 0.27 |

| 1YD.DE | 0.35 | -0.03 | 0.07 | 0.04 | 0.10 | 0.12 | 0.31 | 0.16 | 1.00 | 0.30 | 0.21 | 0.27 | 0.31 |

| NVDA | 0.63 | 0.01 | 0.06 | 0.12 | 0.08 | 0.07 | 0.14 | 0.25 | 0.30 | 1.00 | 0.23 | 0.41 | 0.38 |

| SVARX | 0.41 | 0.14 | 0.08 | 0.06 | 0.13 | 0.14 | 0.19 | 0.17 | 0.21 | 0.23 | 1.00 | 0.61 | 0.35 |

| HFSAX | 0.70 | 0.13 | 0.07 | 0.13 | 0.14 | 0.15 | 0.26 | 0.34 | 0.27 | 0.41 | 0.61 | 1.00 | 0.45 |

| Portfolio | 0.51 | 0.08 | 0.17 | 0.62 | 0.31 | 0.48 | 0.35 | 0.27 | 0.31 | 0.38 | 0.35 | 0.45 | 1.00 |

Recent discussions

New Ticker Request please: AVLC

Jeff Stephan

dividends

Dennis Nolen

PortfoliosLab Trends Portfolio Rebalance (October 2023)

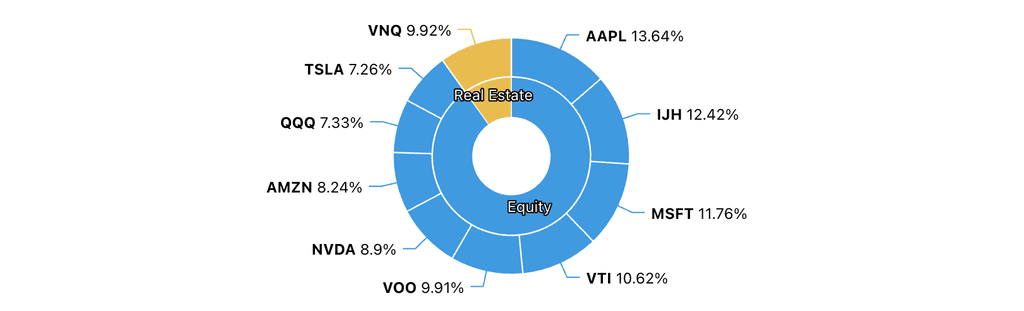

The PortfoliosLab Trends Portfolio has been rebalanced today. Every three months, we analyze all user portfolios on PortfoliosLab, select the top 10 symbols that make up those portfolios, and weigh them by popularity.

In this update, the Invesco QQQ ETF has been newly added with a weight of 7.33%. The Schwab US Dividend Equity ETF has been removed; it previously held a weight of 6.95%.

Other noteworthy changes include a drop in the Vanguard Total Stock Market ETF popularity from 11.35% to 10.62% and a rise in the iShares Core S&P Mid-Cap ETF from 11.87% to 12.42%. But overall, the portfolio remains stable, with other changes in it being relatively minor.

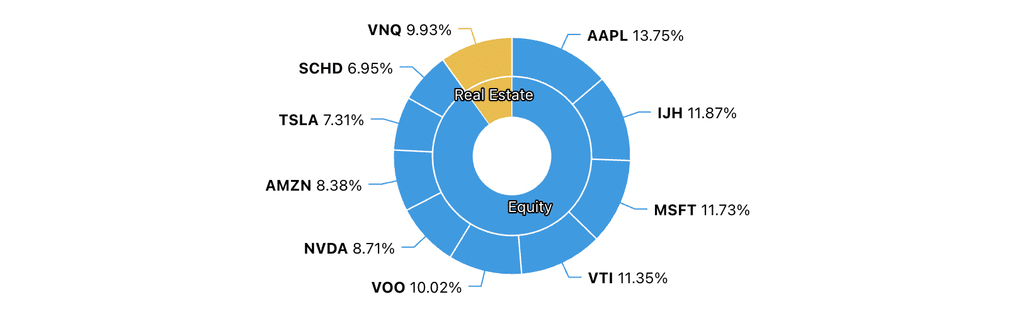

Previous allocation

New allocation

The portfolio remains heavily weighted in technology, with symbols like AAPL, MSFT, and NVDA, which suggests a generally bullish sentiment on the tech sector. The addition of QQQ, which tracks the NASDAQ-100 Index, further reinforces this focus. The removal of SCHD could signal a shift away from dividend-yielding stocks towards growth or sector-specific assets.

Stay tuned for our next rebalancing update in three months to see how market trends continue to influence this unique portfolio.

Dmitry Shevchenko