PortfoliosLab Trends Portfolio Rebalance (October 2023)

The PortfoliosLab Trends Portfolio has been rebalanced today. Every three months, we analyze all user portfolios on PortfoliosLab, select the top 10 symbols that make up those portfolios, and weigh them by popularity.

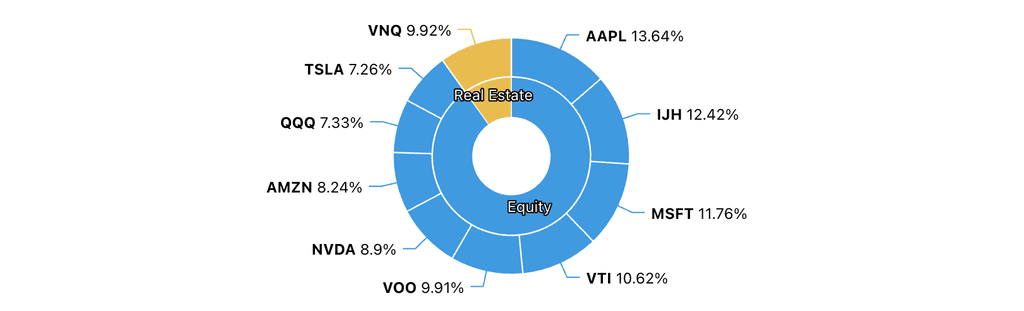

In this update, the Invesco QQQ ETF has been newly added with a weight of 7.33%. The Schwab US Dividend Equity ETF has been removed; it previously held a weight of 6.95%.

Other noteworthy changes include a drop in the Vanguard Total Stock Market ETF popularity from 11.35% to 10.62% and a rise in the iShares Core S&P Mid-Cap ETF from 11.87% to 12.42%. But overall, the portfolio remains stable, with other changes in it being relatively minor.

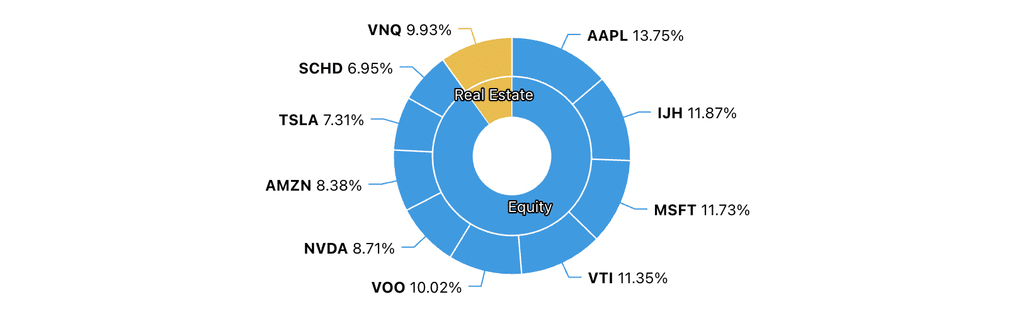

Previous allocation

New allocation

The portfolio remains heavily weighted in technology, with symbols like AAPL, MSFT, and NVDA, which suggests a generally bullish sentiment on the tech sector. The addition of QQQ, which tracks the NASDAQ-100 Index, further reinforces this focus. The removal of SCHD could signal a shift away from dividend-yielding stocks towards growth or sector-specific assets.

Stay tuned for our next rebalancing update in three months to see how market trends continue to influence this unique portfolio.

6 comments

1 reply

Sort by

I also appreciated this new function that you have created, it is probably useful in understanding sentiment more than providing analytical data useful for recomposition and rebalancing.

What would be a very very interesting thing instead is to create a function that gives each user, in the optimization section of their portfolio, the ability to see with a quadratic optimization, for example, what the quarterly history of recomposition and rebalancing has been, understand the maximum exposure in terms of the amount of assets in the portfolio over time and so on. it's probably a necessary if not indispensable measure (in my opinion).

I hope this feature will be implemented and I am confident that it will be implemented because of your expertise, which has proven to be really excellent so far.

Keep up the good work, you are great at what you do!

Looks like 40% VTI and 60% QQQ.

No ex-US diversification. Using a developed world tracker to give the same 4:6 ratio:

50% Nasdaq 100

50% FTSE Developed World

Gains 15% ex-US developed world allocation.

Out of idle curiosity, the previous trends allocation looked like 40% VTI, 50% QQQ, and 10% US value. That would have been a similar allocation to the above for developed world investors, with some Nasdaq 100 allocation pivoted towards their choice of US value.

This could have been further simplified, as growth and value are two sides of the same coin. Leaving the hypothetical US investor with 60% VTI and 40% QQQ, and the developed world investor with 30% Nasdaq 100 and 70% FTSE Developed World.

Also interested to see what the composition of latest Trends Portfolio is.

Could ya'll provide a revised portfolio based on the latest trends?