Invest smarter, not harder: get data-driven insights

Transform complex data into actionable insights with our professional yet simple tools.

Unique indicators used by leading quantum funds

Risk, profitability, and dividend analysis

Beginner-friendly interface, expert-ready functionality

Hassle-free solutions for mundane tasks

Unique indicators used by leading quantum funds

Risk, profitability, and dividend analysis

Beginner-friendly interface, expert-ready functionality

Hassle-free solutions for mundane tasks

Simplify Wealth Building for You and Your Clients

For Enthusiasts

Unique indicators used by leading quantum funds

Get a detailed professional analysis instead of raw data

Use the service smoothly: no special knowledge needed

Make decisions based not only on the potential returns but also on the risks involved

Gain valuable insights with our curated Lazy Portfolios or diverse User Portfolios

For Enthusiasts

Unique indicators used by leading quantum funds

Get a detailed professional analysis instead of raw data

Use the service smoothly: no special knowledge needed

Make decisions based not only on the potential returns but also on the risks involved

Gain valuable insights with our curated Lazy Portfolios or diverse User Portfolios

For Fund Managers

Manage all the data in one place

Import your own data to PortfoliosLab

Export any data for use in external systems

Utilize hundreds of screener settings

Work with large portfolios (up to 500 positions) and manage your own data

Access indicators based on the latest research

For Financial Advisors

Scale up your business and get more clients

Make convincing presentations to attract new clients using detailed analysis

Create and showcase strategies for various investment goals

Maintain and optimize your clients portfolios with professional tools

Generate reports in a few clicks

Get sharper insights with more than 20 tools

Analyze market trends, stocks, funds, and any other data for the past 40+ years.

Optimization

Grow your portfolio's earnings and keep the risks low. Find the right mix of investments based on your goals.

Performance Analysis

Visualize the gains or losses of a certain portfolio and evaluate its real profitability relative to risk.

Risk Analysis

Estimate stock volatility with nine different instruments, including Drawdowns, Expected Shortfall, and the Ulcer Index. Reduce the likelihood of sudden losses and ultimately improve the risk-adjusted returns of your portfolio.

Compare stocks and decide in seconds

Compare key performance indicators of stocks and pinpoint essential details on the chart.

Build your personal investment hub

Upload & save portfolios

Save the portfolios you use frequently to speed up your work

Customize screener filters

Customize and save the screener settings that work best for you

Maintain up to 10 watchlists

Follow companies you don't have in your portfolio to monitor their dynamics

Use for free, or get more options

Log in to try out most of our tools for free. Subscribe to use them without limits.

Free

0.00 $

per month

Unlimited public portfolios

15 holdings per portfolio

1 watchlist

10 calculations per month

10 years of historical data

Portfolio optimization

Investment analysis tools

Screeners

Plus

7.99 $

per month

All the features of Free

5 private portfolios

100 holdings per portfolio

5 watchlists

200 calculations per month

40+ years of historical data

Advanced risk metrics

Ad free

Pro

19.00 $

per month

All the features of Plus

Unlimited private portfolios

500 holdings per portfolio

10 watchlists

Unlimited monthly calculations

Export screener results

Import you own data

Priority support

Pro+

99.00 $

per month

All the features of Pro

API access

Try out new platform updates

Many of our best updates came directly from user suggestions. Is there a feature you're looking for that we haven't added yet? Share your ideas, and let us know how we can make your experience even better!

March 01, 25

New: Valuation & Profitability Insights

We're excited to announce two powerful new sections now live on PortfoliosLab:

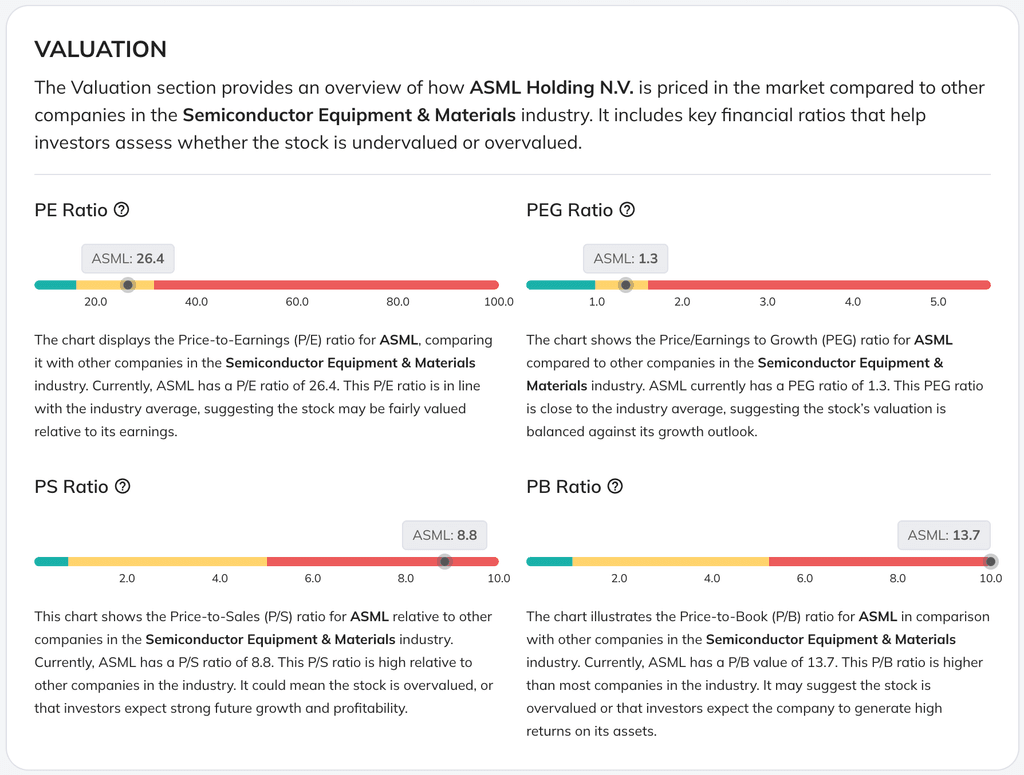

Valuation Analysis

Gain deeper insights into how stocks are priced compared to their peers in the same industry. Now featuring essential valuation metrics:

- P/E Ratio: Evaluate stock prices relative to company earnings.

- PEG Ratio: Balance stock valuation against expected growth.

- P/S Ratio: Understand valuations relative to company sales.

- P/B Ratio: Assess how stocks are priced in relation to their book value.

Each valuation metric compares a company directly to its industry peers, clearly marking zones indicating if the stock is undervalued, fairly valued, or overvalued relative to the industry average.

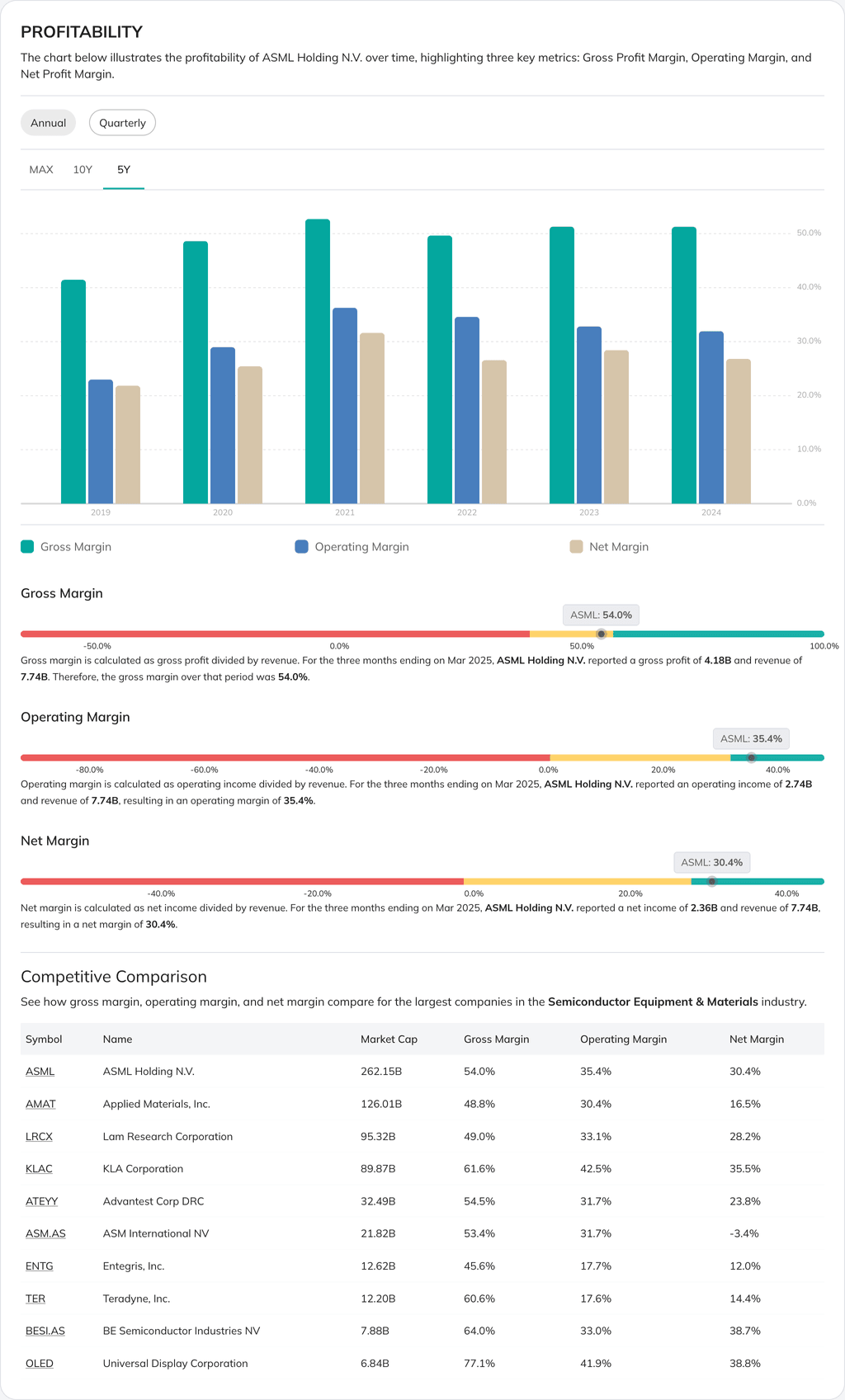

Profitability Insights

Explore key profitability metrics to better understand company performance:

- Gross Margin: Measure how efficiently a company generates revenue from its direct costs.

- Operating Margin: Evaluate operating efficiency and how well a company manages operating costs.

- Net Margin: Gauge overall profitability after all expenses.

Profitability metrics are benchmarked against industry peers, clearly identifying whether a company is underperforming, performing on par, or overperforming in terms of profitability.

The new features are live for all equity stocks on PortfoliosLab and are available to all users.

February 02, 25

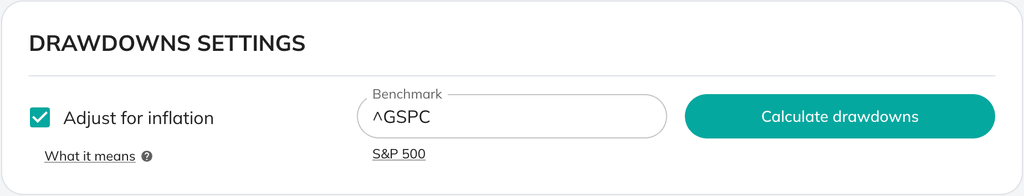

New: Inflation-Adjusted Performance & Drawdowns

We’ve added support for inflation-adjusted performance and drawdown calculations, giving you a clearer picture of how your portfolio performs in real economic terms.

Nominal returns alone don't reflect how much value your portfolio is truly gaining (or losing) over time. Inflation erodes purchasing power, so what looks like positive performance on paper may not translate to real-world growth.

With this update, you can now adjust performance metrics to account for inflation and view drawdowns in real terms, showing actual value loss and recovery.

A drawdown typically tracks how far a portfolio falls from a peak and how long it takes to recover. However, in most cases, a true recovery isn’t just returning to the previous nominal high, it means the portfolio’s value must grow enough to outpace inflation over the entire drawdown period.

By adjusting for inflation, you get a more accurate view of:

- How deep the loss really was

- How long it truly took to recover

- Whether your capital actually regained its real-world value

This makes the drawdown metric significantly more informative, especially for long-term investors. You can explore these updates directly in the following tools: Portfolio Performance Calculator, and Drawdown Analysis Tool.

Just check the “Adjust for inflation” option on the settings panel:

We use CPI data from FRED to adjust for inflation, helping you better understand your portfolio’s real-world performance.

December 30, 24

Threshold-based Portfolio Rebalancing, Portfolio Screening by Positions, and More!

We're wrapping up 2024 with another platform update packed with exciting new features and enhancements!

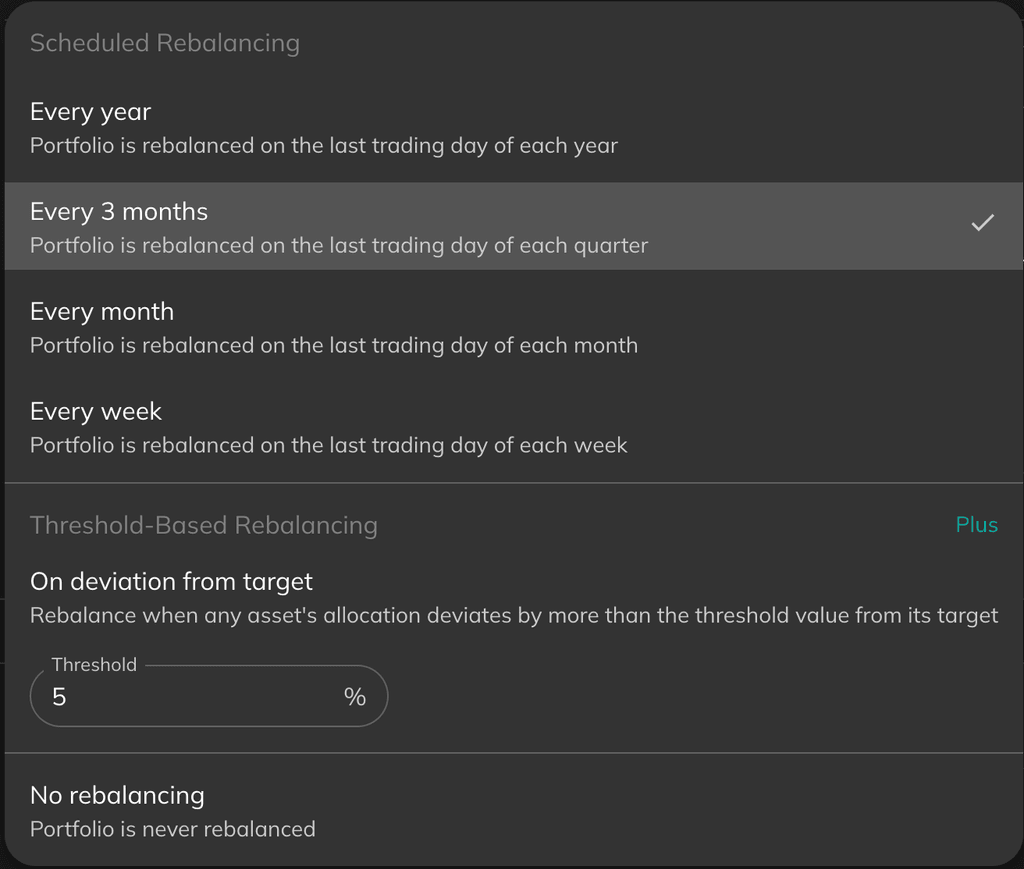

Threshold-Based Portfolio Rebalancing

A new threshold-based rebalancing method is now available! In addition to scheduled rebalancing, you can now configure rebalancing based on a threshold value. Rebalancing is triggered when an asset's weight in the portfolio exceeds or falls below the set threshold relative to its target allocation.

For example, if an asset is targeted at 20% of the portfolio with a 5% threshold, rebalancing would occur if its allocation drops below 15% or rises above 25%. Unlike calendar-based rebalancing, this method responds dynamically to market movements and asset performance, offering a more adaptive approach to portfolio management.

You can now save your portfolio rebalancing settings. Previously, all portfolios defaulted to rebalancing once every three months upon saving. We'll also be adjusting existing lazy portfolios to incorporate more relevant rebalancing settings.

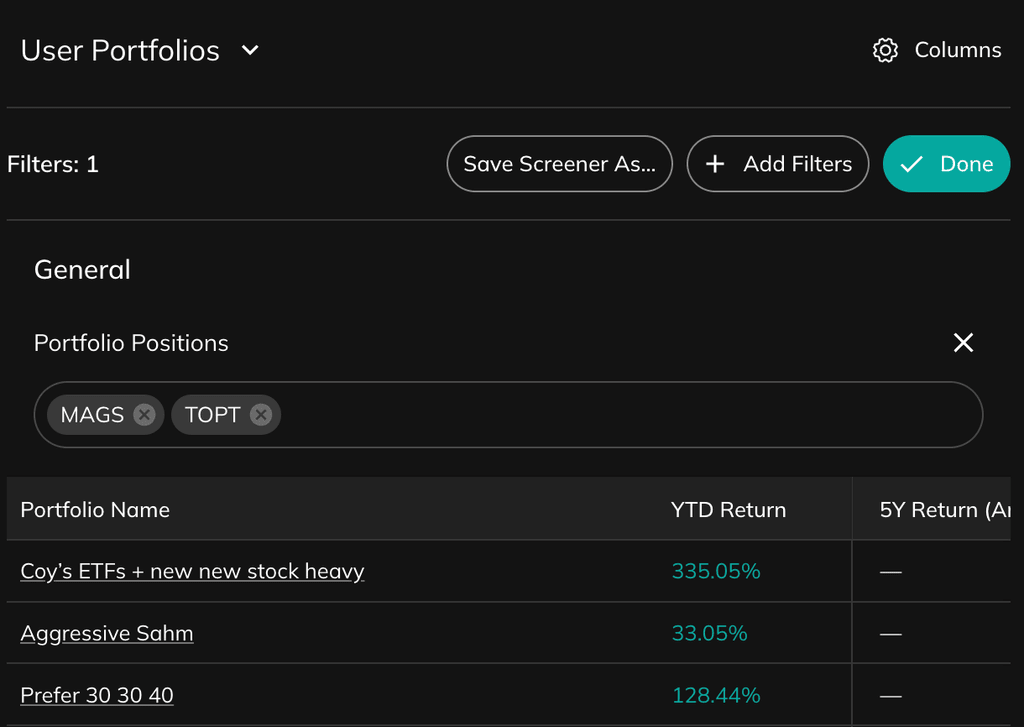

Enhanced Portfolio Screening

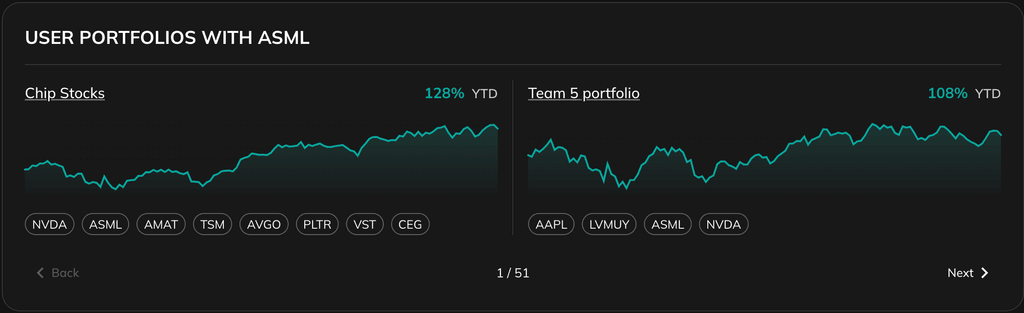

The portfolio screener now includes a new feature to filter user portfolios by specific tickers. It’s easier than ever to explore insights from the vast user portfolio base on PortfoliosLab, focusing on portfolios that include particular stocks or funds.

When viewing individual tickers, such as stocks or ETFs, you can quickly see public user portfolios containing that ticker. This provides instant access to top-performing portfolios featuring the selected asset. Look for this section at the bottom of the page.

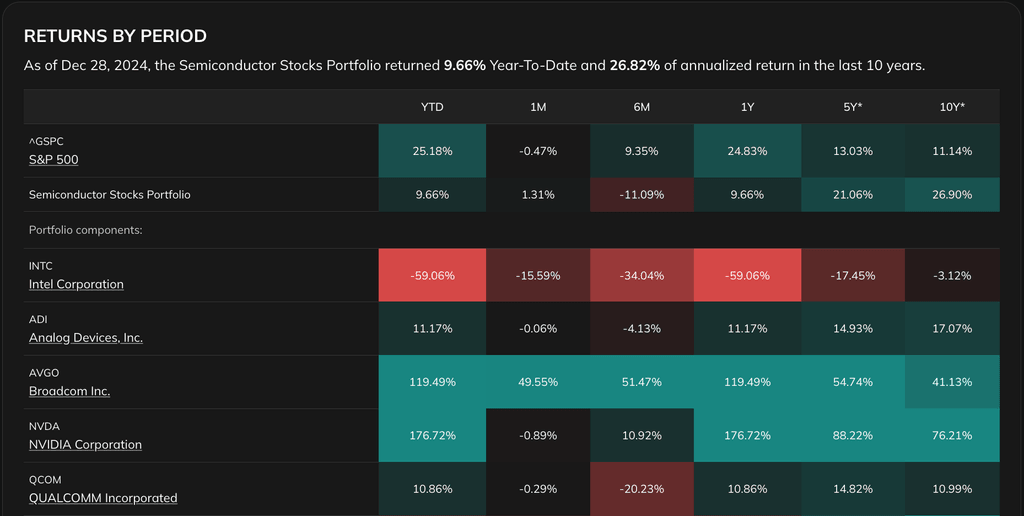

Portfolio Returns Table Update

We've updated the portfolio returns table to include color-coded returns for quicker comparisons among portfolio constituents.

Other Improvements

Minor UI enhancements have been made to improve site clarity and responsiveness.

Happy holiday season! We look forward to bringing you even more updates in the coming year 🎉

Recently added tickers

START TODAY TO GET PROFIT TOMORROW

Earn above-market returns easily

Simplify and speed up your work process

Use actual data based on relevant research

Be confident in your investment decisions