New: Valuation & Profitability Insights

We're excited to announce two powerful new sections now live on PortfoliosLab:

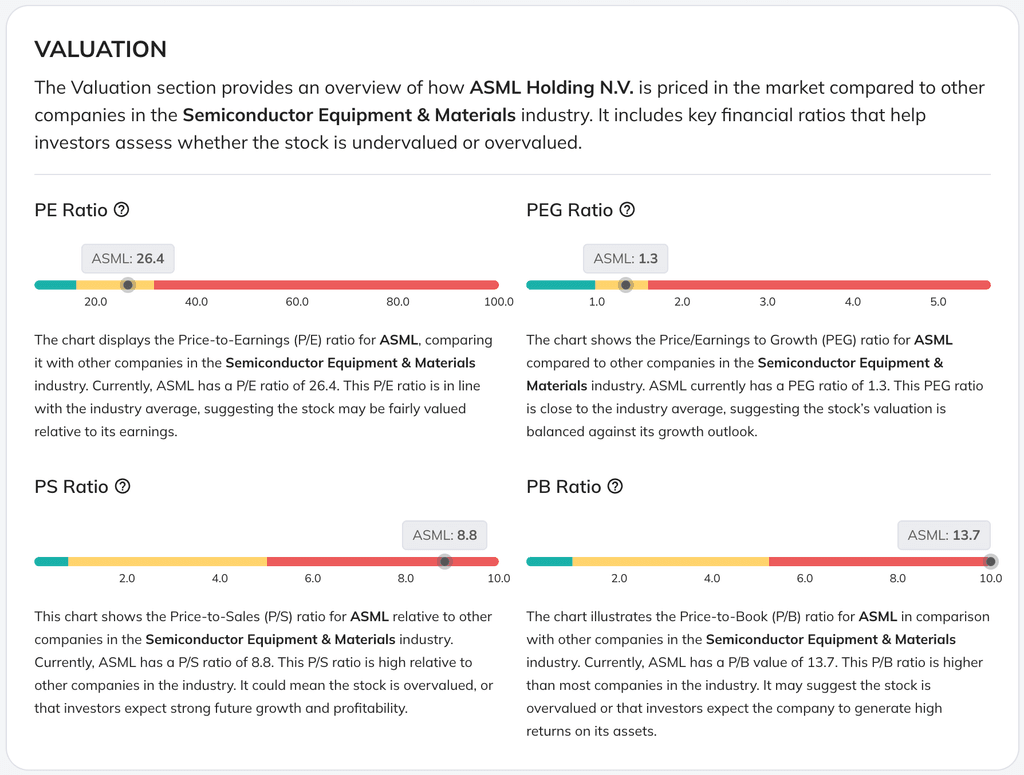

Valuation Analysis

Gain deeper insights into how stocks are priced compared to their peers in the same industry. Now featuring essential valuation metrics:

- P/E Ratio: Evaluate stock prices relative to company earnings.

- PEG Ratio: Balance stock valuation against expected growth.

- P/S Ratio: Understand valuations relative to company sales.

- P/B Ratio: Assess how stocks are priced in relation to their book value.

Each valuation metric compares a company directly to its industry peers, clearly marking zones indicating if the stock is undervalued, fairly valued, or overvalued relative to the industry average.

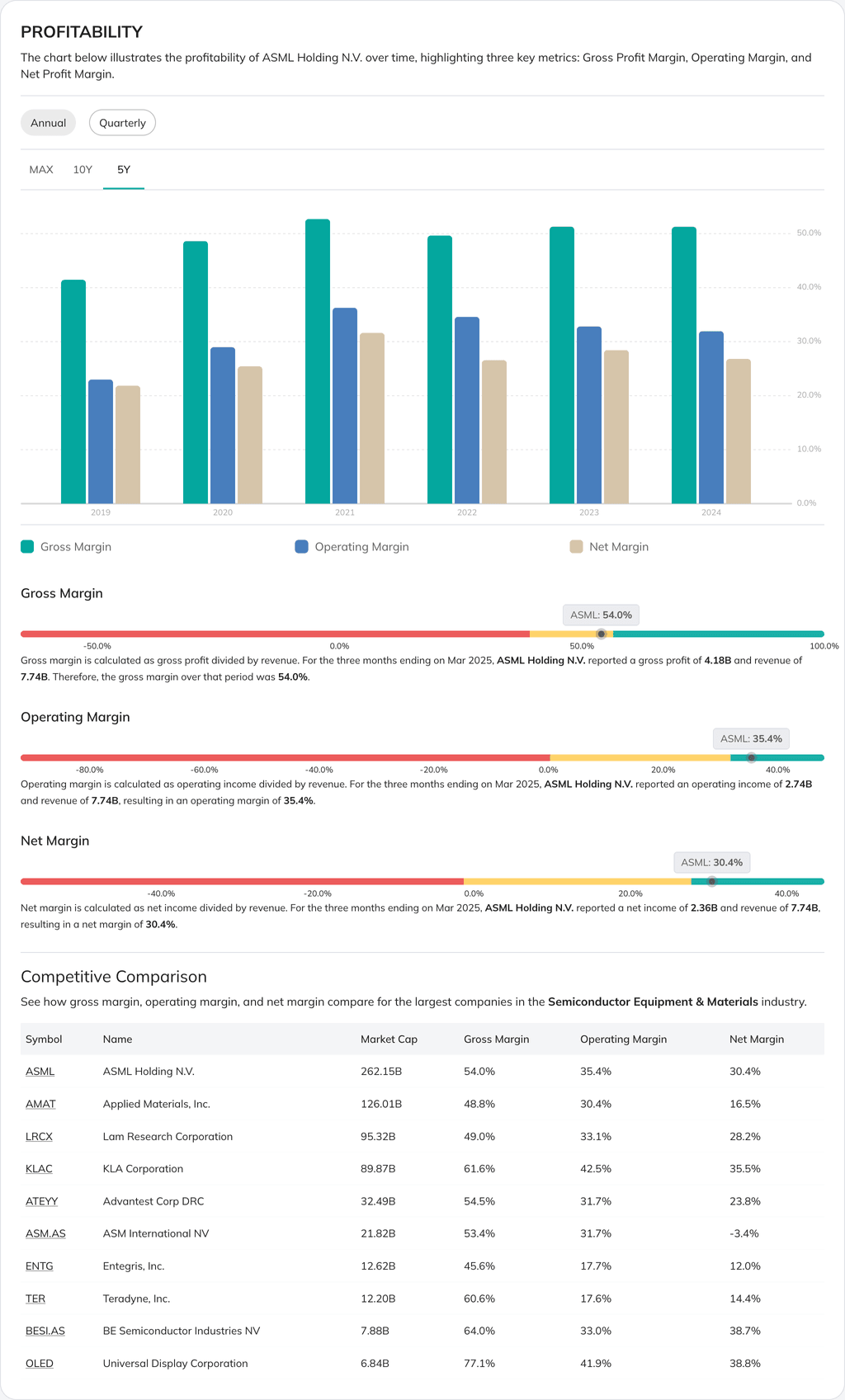

Profitability Insights

Explore key profitability metrics to better understand company performance:

- Gross Margin: Measure how efficiently a company generates revenue from its direct costs.

- Operating Margin: Evaluate operating efficiency and how well a company manages operating costs.

- Net Margin: Gauge overall profitability after all expenses.

Profitability metrics are benchmarked against industry peers, clearly identifying whether a company is underperforming, performing on par, or overperforming in terms of profitability.

The new features are live for all equity stocks on PortfoliosLab and are available to all users.

0 comments

Sort by