Threshold-based Portfolio Rebalancing, Portfolio Screening by Positions, and More!

We're wrapping up 2024 with another platform update packed with exciting new features and enhancements!

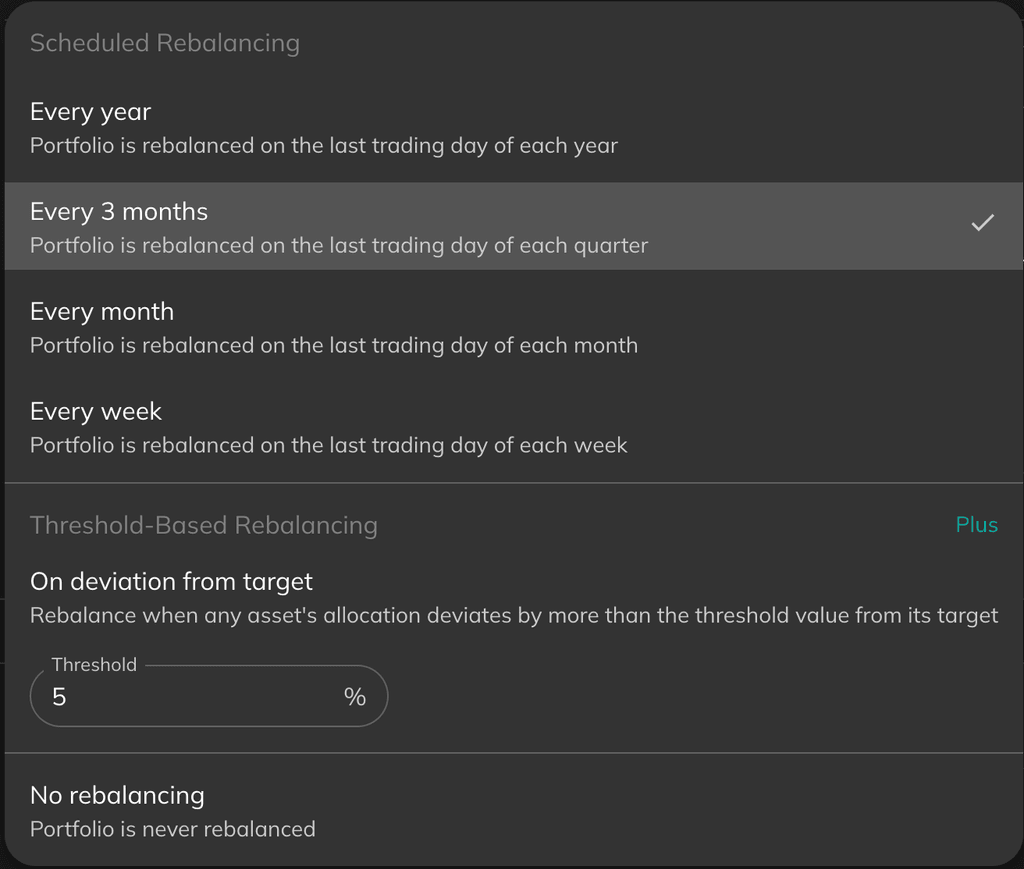

Threshold-Based Portfolio Rebalancing

A new threshold-based rebalancing method is now available! In addition to scheduled rebalancing, you can now configure rebalancing based on a threshold value. Rebalancing is triggered when an asset's weight in the portfolio exceeds or falls below the set threshold relative to its target allocation.

For example, if an asset is targeted at 20% of the portfolio with a 5% threshold, rebalancing would occur if its allocation drops below 15% or rises above 25%. Unlike calendar-based rebalancing, this method responds dynamically to market movements and asset performance, offering a more adaptive approach to portfolio management.

You can now save your portfolio rebalancing settings. Previously, all portfolios defaulted to rebalancing once every three months upon saving. We'll also be adjusting existing lazy portfolios to incorporate more relevant rebalancing settings.

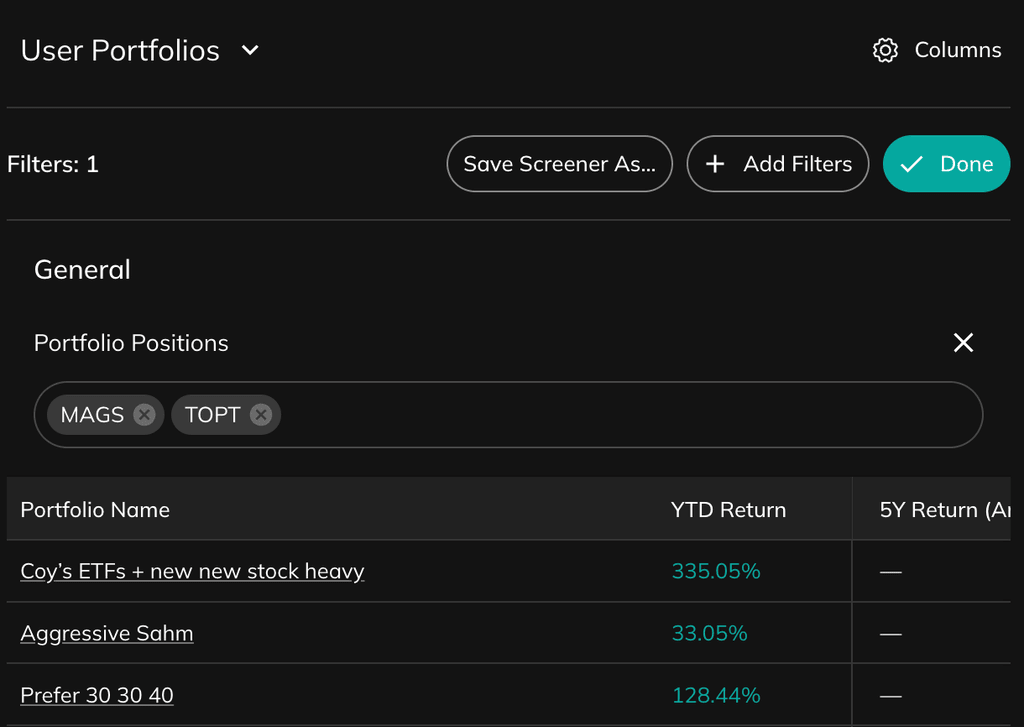

Enhanced Portfolio Screening

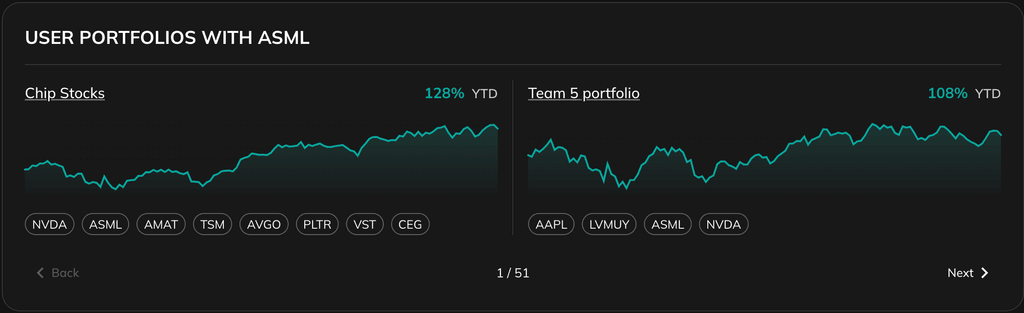

The portfolio screener now includes a new feature to filter user portfolios by specific tickers. It’s easier than ever to explore insights from the vast user portfolio base on PortfoliosLab, focusing on portfolios that include particular stocks or funds.

When viewing individual tickers, such as stocks or ETFs, you can quickly see public user portfolios containing that ticker. This provides instant access to top-performing portfolios featuring the selected asset. Look for this section at the bottom of the page.

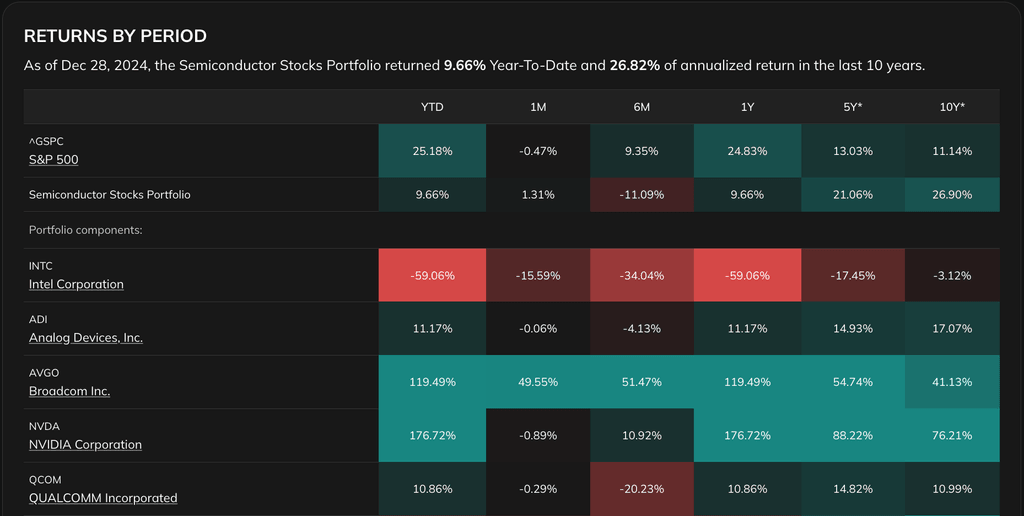

Portfolio Returns Table Update

We've updated the portfolio returns table to include color-coded returns for quicker comparisons among portfolio constituents.

Other Improvements

Minor UI enhancements have been made to improve site clarity and responsiveness.

Happy holiday season! We look forward to bringing you even more updates in the coming year 🎉

0 comments

Sort by