BAP vs. SPY

Compare and contrast key facts about Credicorp Ltd. (BAP) and SPDR S&P 500 ETF (SPY).

SPY is a passively managed fund by State Street that tracks the performance of the S&P 500 Index. It was launched on Jan 22, 1993.

Scroll down to visually compare performance, riskiness, drawdowns, and other indicators and decide which better suits your portfolio: BAP or SPY.

Correlation

The correlation between BAP and SPY is 0.37, which is considered to be low. This implies their price changes are not closely related. A low correlation is generally favorable for portfolio diversification, as it helps to reduce overall risk by spreading it across multiple assets with different performance patterns.

Performance

BAP vs. SPY - Performance Comparison

Loading data...

Key characteristics

BAP:

1.23

SPY:

0.66

BAP:

1.47

SPY:

1.08

BAP:

1.18

SPY:

1.16

BAP:

0.91

SPY:

0.72

BAP:

4.92

SPY:

2.78

BAP:

4.93%

SPY:

4.88%

BAP:

24.46%

SPY:

20.26%

BAP:

-73.44%

SPY:

-55.19%

BAP:

0.00%

SPY:

-2.99%

Returns By Period

In the year-to-date period, BAP achieves a 14.50% return, which is significantly higher than SPY's 1.46% return. Over the past 10 years, BAP has underperformed SPY with an annualized return of 6.25%, while SPY has yielded a comparatively higher 12.71% annualized return.

BAP

14.50%

13.38%

8.48%

29.99%

17.13%

11.04%

6.25%

SPY

1.46%

12.62%

1.07%

13.27%

16.71%

16.68%

12.71%

Compare stocks, funds, or ETFs

Search for stocks, ETFs, and funds for a quick comparison or use the comparison tool for more options.

Risk-Adjusted Performance

BAP vs. SPY — Risk-Adjusted Performance Rank

BAP

SPY

BAP vs. SPY - Risk-Adjusted Performance Comparison

This table presents a comparison of risk-adjusted performance metrics for Credicorp Ltd. (BAP) and SPDR S&P 500 ETF (SPY). Risk-adjusted metrics are performance indicators that assess an investment's returns in relation to its risk, enabling a more accurate comparison of different investment options.

Loading data...

Dividends

BAP vs. SPY - Dividend Comparison

BAP's dividend yield for the trailing twelve months is around 6.91%, more than SPY's 1.21% yield.

| TTM | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

BAP Credicorp Ltd. | 6.91% | 2.10% | 0.45% | 0.29% | 4.10% | 5.37% | 3.94% | 0.20% | 4.32% | 1.47% | 2.25% | 1.19% |

SPY SPDR S&P 500 ETF | 1.21% | 1.21% | 1.40% | 1.65% | 1.20% | 1.52% | 1.75% | 2.04% | 1.80% | 2.03% | 2.06% | 1.87% |

Drawdowns

BAP vs. SPY - Drawdown Comparison

The maximum BAP drawdown since its inception was -73.44%, which is greater than SPY's maximum drawdown of -55.19%. Use the drawdown chart below to compare losses from any high point for BAP and SPY. For additional features, visit the drawdowns tool.

Loading data...

Volatility

BAP vs. SPY - Volatility Comparison

Credicorp Ltd. (BAP) has a higher volatility of 6.12% compared to SPDR S&P 500 ETF (SPY) at 4.66%. This indicates that BAP's price experiences larger fluctuations and is considered to be riskier than SPY based on this measure. The chart below showcases a comparison of their rolling one-month volatility.

Loading data...

User Portfolios with BAP or SPY

Recent discussions

Discrepancy between SPY and ^GSPC?

Hello, from the charts, SPY seems to be outperforming its benchmark ^GSPC. That looks strange. From my understanding, SPY is designed to closely track the S&P 500.

Could there be an error in the charts?

Hedge Cat

Understanding annualized return

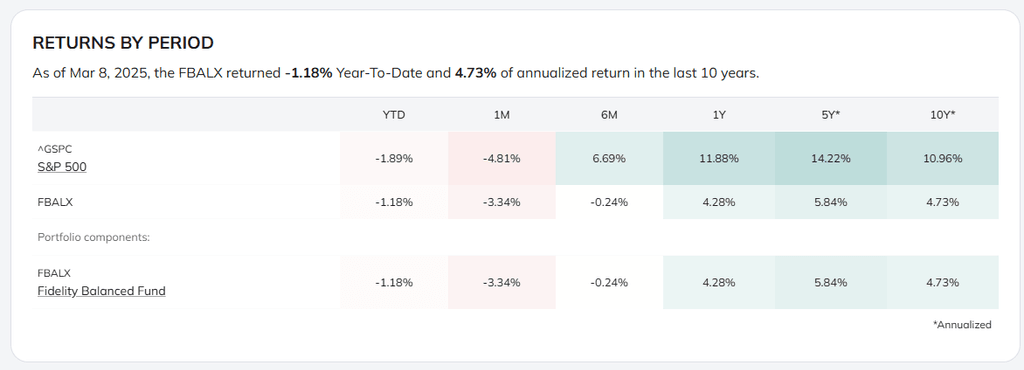

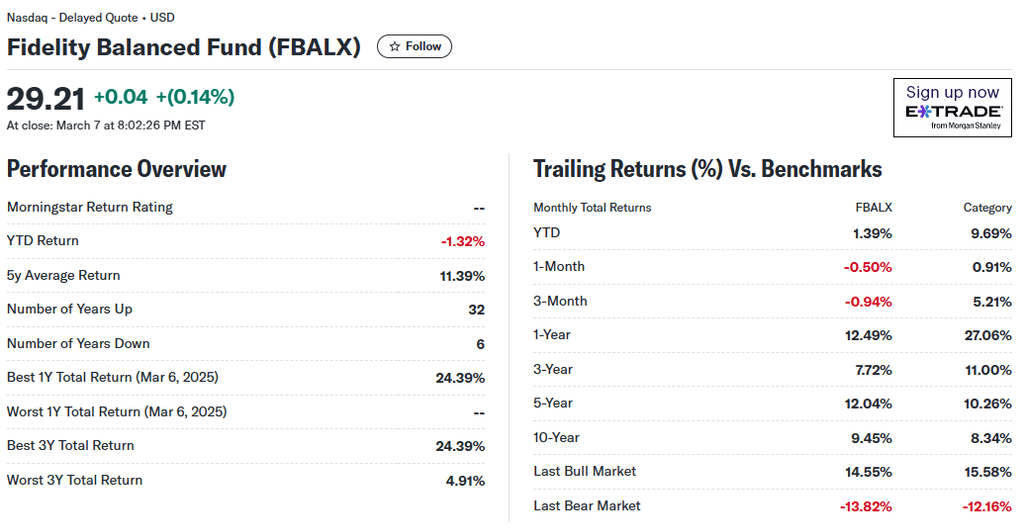

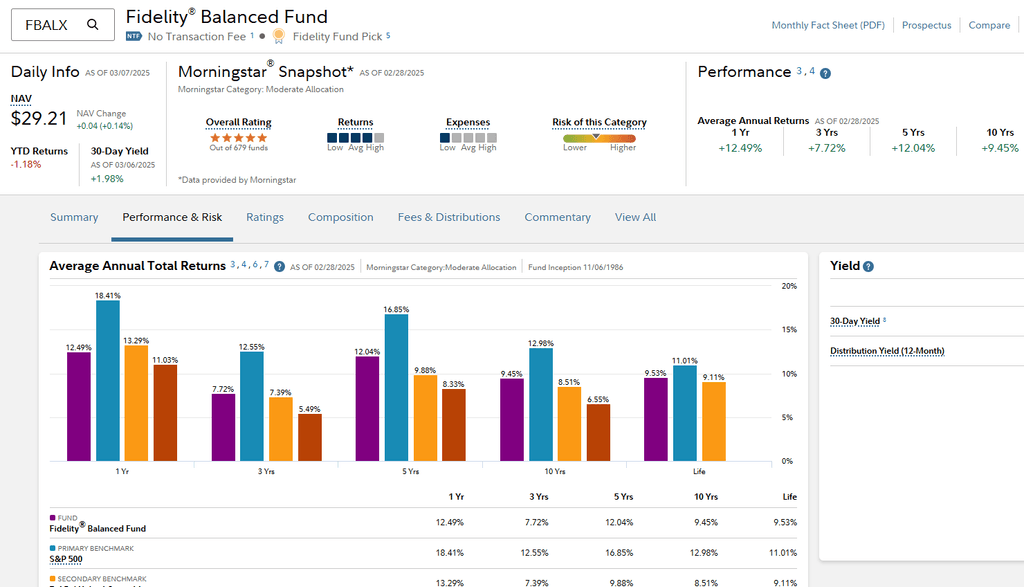

I'm trying to understand the difference between the annualized 10-yr return of FBALX reported here at 4.73% vs other sites at 9.45%.

Screenshots from PortfoliosLab, Yahoo Finance, and Fidelity below.

What am I missing? Thanks in advance.

https://portfolioslab.com/portfolio/gaftrwmj24whdrduj87s4xge

https://finance.yahoo.com/quote/FBALX/performance/

https://fundresearch.fidelity.com/mutual-funds/performance-and-risk/316345206

Steve

How is Sharpe ratio calculated?

The highest sharpe ratio portfolioi in User portfolios holds only ultrashort treasuries and show a sharpe ratio of 7+. But my understanding is the Sharpe ratio is the return less the risk-free rate divided by the standard deviation of returns. But short-term treasuries ARE the risk free rate, so the Sharpe ratio should be zero since the risk free rate minus the risk free rate is zero. So are you simply ignoring the risk-free rate and dividing returns by the standard deviation???

Addendum:

Just input my portfolio and asked that your site optimize it for Sharpe ratio. I have ready cash in USFR, and ETF that holds US floating rate notes exclusively. The optimization recommended I put over 99% in USFR. However, the interest rate on floating rate notes is based on the three month treasury, so again, USFR has a Sharpe ratio of zero! Please correct this!

Bob Peticolas