FFSM vs. AVUV

Compare and contrast key facts about Fidelity Fundamental Small-Mid Cap ETF (FFSM) and Avantis U.S. Small Cap Value ETF (AVUV).

FFSM and AVUV are both exchange-traded funds (ETFs), meaning they are traded on stock exchanges and can be bought and sold throughout the day. FFSM is an actively managed fund by Fidelity. It was launched on Feb 2, 2021. AVUV is an actively managed fund by American Century Investments. It was launched on Sep 24, 2019.

Scroll down to visually compare performance, riskiness, drawdowns, and other indicators and decide which better suits your portfolio: FFSM or AVUV.

Correlation

The correlation between FFSM and AVUV is 0.73, which is considered to be high. That indicates a strong positive relationship between their price movements. Having highly-correlated positions in a portfolio may signal a lack of diversification, potentially leading to increased risk during market downturns.

Maximize Your Portfolio’s Potential

Does your portfolio have the optimal asset allocation aligned with your goals? Find it out with our portfolio optimizer

Try portfolio optimization nowPerformance

FFSM vs. AVUV - Performance Comparison

Loading data...

Key characteristics

FFSM:

0.05

AVUV:

-0.14

FFSM:

0.17

AVUV:

-0.08

FFSM:

1.02

AVUV:

0.99

FFSM:

0.00

AVUV:

-0.16

FFSM:

0.00

AVUV:

-0.43

FFSM:

8.16%

AVUV:

10.71%

FFSM:

23.48%

AVUV:

25.63%

FFSM:

-26.65%

AVUV:

-49.42%

FFSM:

-11.88%

AVUV:

-17.08%

Returns By Period

In the year-to-date period, FFSM achieves a -3.48% return, which is significantly higher than AVUV's -8.98% return.

FFSM

-3.48%

10.12%

-9.55%

1.23%

9.21%

N/A

N/A

AVUV

-8.98%

8.41%

-14.14%

-3.54%

7.41%

20.40%

N/A

Compare stocks, funds, or ETFs

Search for stocks, ETFs, and funds for a quick comparison or use the comparison tool for more options.

FFSM vs. AVUV - Expense Ratio Comparison

FFSM has a 0.43% expense ratio, which is higher than AVUV's 0.25% expense ratio.

Risk-Adjusted Performance

FFSM vs. AVUV — Risk-Adjusted Performance Rank

FFSM

AVUV

FFSM vs. AVUV - Risk-Adjusted Performance Comparison

This table presents a comparison of risk-adjusted performance metrics for Fidelity Fundamental Small-Mid Cap ETF (FFSM) and Avantis U.S. Small Cap Value ETF (AVUV). Risk-adjusted metrics are performance indicators that assess an investment's returns in relation to its risk, enabling a more accurate comparison of different investment options.

Loading data...

Dividends

FFSM vs. AVUV - Dividend Comparison

FFSM's dividend yield for the trailing twelve months is around 0.69%, less than AVUV's 1.82% yield.

| TTM | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | |

|---|---|---|---|---|---|---|---|

FFSM Fidelity Fundamental Small-Mid Cap ETF | 0.69% | 0.62% | 0.56% | 0.58% | 0.37% | 0.00% | 0.00% |

AVUV Avantis U.S. Small Cap Value ETF | 1.82% | 1.61% | 1.65% | 1.74% | 1.28% | 1.21% | 0.38% |

Drawdowns

FFSM vs. AVUV - Drawdown Comparison

The maximum FFSM drawdown since its inception was -26.65%, smaller than the maximum AVUV drawdown of -49.42%. Use the drawdown chart below to compare losses from any high point for FFSM and AVUV. For additional features, visit the drawdowns tool.

Loading data...

Volatility

FFSM vs. AVUV - Volatility Comparison

The current volatility for Fidelity Fundamental Small-Mid Cap ETF (FFSM) is 5.90%, while Avantis U.S. Small Cap Value ETF (AVUV) has a volatility of 6.41%. This indicates that FFSM experiences smaller price fluctuations and is considered to be less risky than AVUV based on this measure. The chart below showcases a comparison of their rolling one-month volatility.

Loading data...

User Portfolios with FFSM or AVUV

8%

YTD

Recent discussions

Understanding annualized return

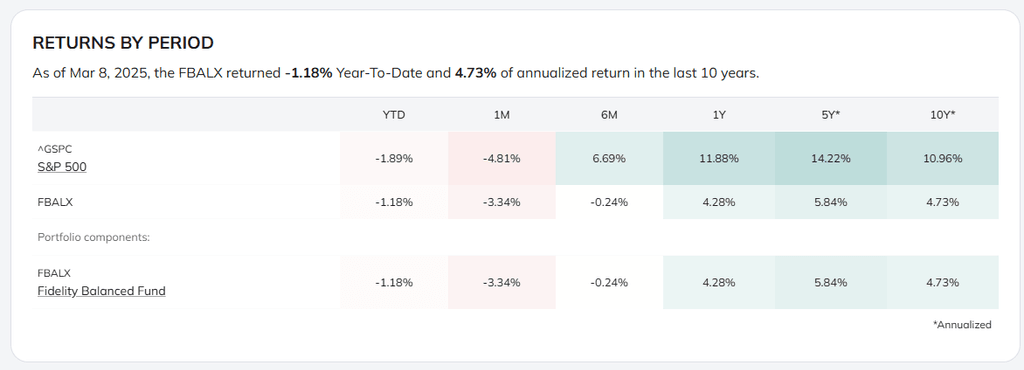

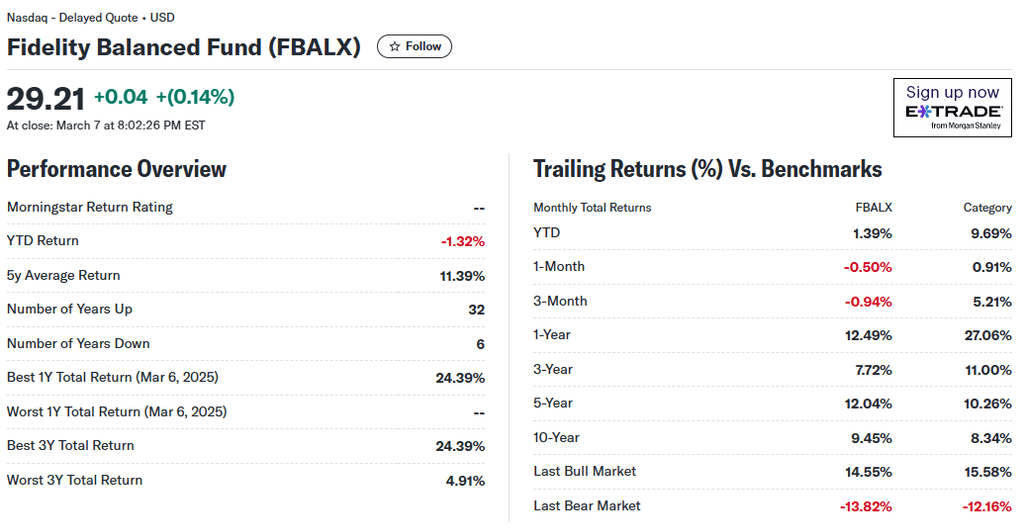

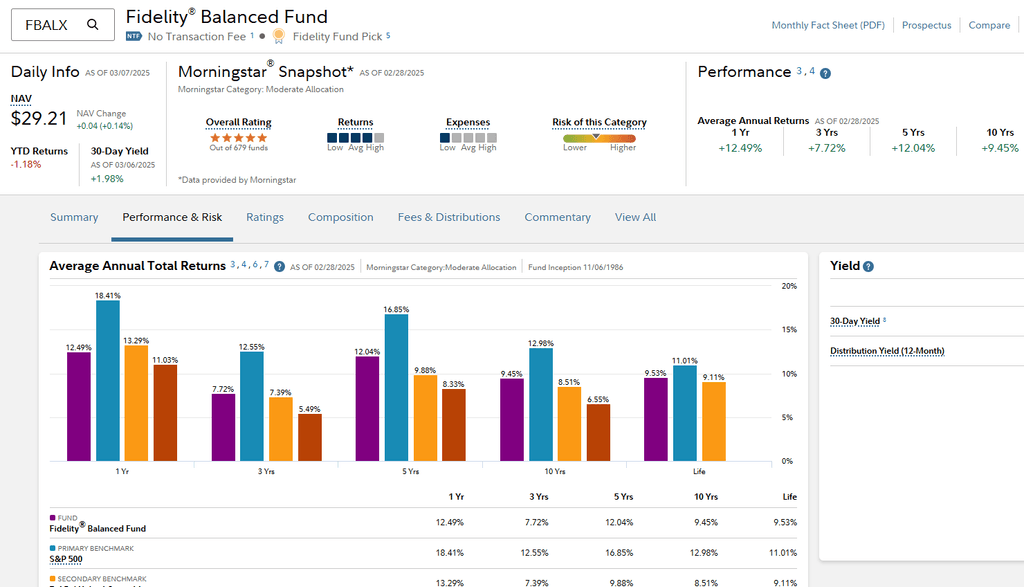

I'm trying to understand the difference between the annualized 10-yr return of FBALX reported here at 4.73% vs other sites at 9.45%.

Screenshots from PortfoliosLab, Yahoo Finance, and Fidelity below.

What am I missing? Thanks in advance.

https://portfolioslab.com/portfolio/gaftrwmj24whdrduj87s4xge

https://finance.yahoo.com/quote/FBALX/performance/

https://fundresearch.fidelity.com/mutual-funds/performance-and-risk/316345206

Steve

Return and Dividend Calculation

Farshad

Colors of plots

A lot of the colors used in plotting multiple investments (like the stock comparison graphs) are very close to each other. It's often very difficult to distinguish between them.

Is it possible to change these colors myself? If not, is that a feature in the pipeline?

Thanks

BB