Introducing Risk-Adjusted Performance Ranks

We are excited to introduce a new addition to the risk-adjusted performance section on PortfoliosLab: Risk-Adjusted Performance Ranks. This feature quickly highlights the market position of an instrument based on its current performance values.

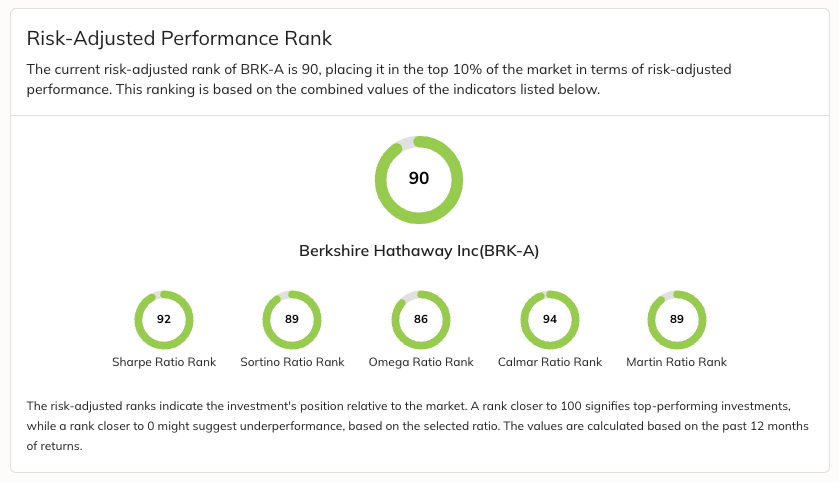

Rank values range from 0 to 100, representing a percentile position in the market. For instance, a rank of 10 indicates that the instrument is in the bottom 10% of the market based on current indicators, whereas a rank of 90 means it is performing better than 90% of the market, placing it in the top 10% of performers.

This feature is available across all plans, including the free tier, and for all instruments like stocks, ETFs, and funds. We update the ranks daily based on the latest trading data, using data from the past 12 months.

0 comments

Sort by