Does Portfolio Performance Consider Historical Composition?

When I see the past performance of a particular portfolio, does it mean the performance of the current composition, or do I get the performance by weighting the portfolio against all its old compositions?

It is very important to learn about the success of the portfolio.

1 comment

2 replies

Sort by

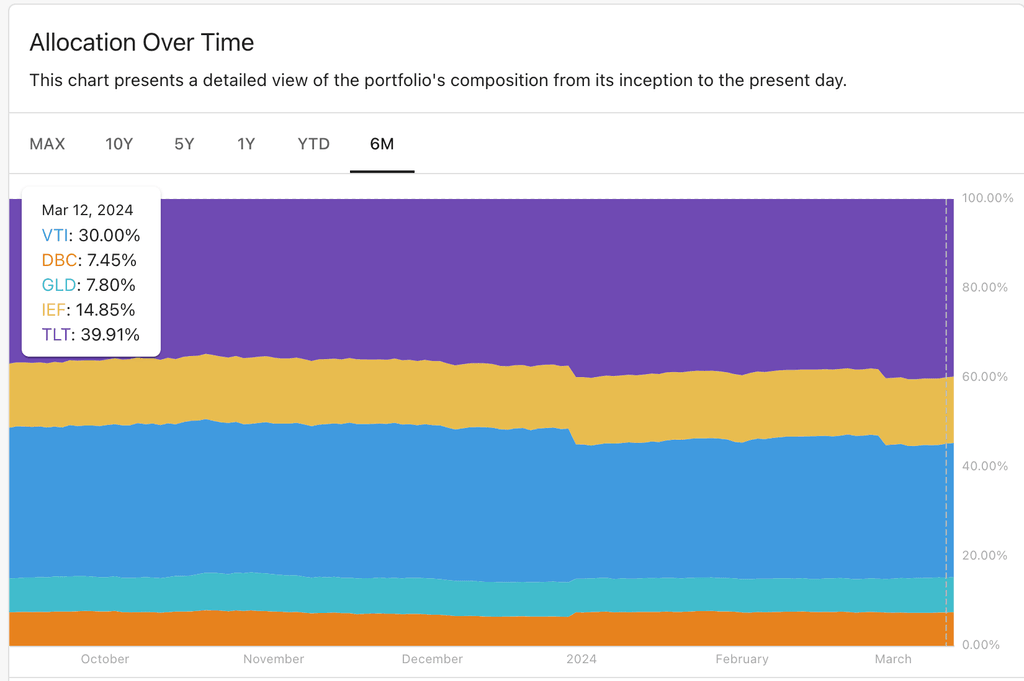

Hi, the portfolio performance calculations account for the historical composition of a portfolio, which could be affected by its rebalance settings for static portfolios or actual holdings for transactional portfolios. With the portfolio performance tool, you can easily visualize a portfolio's historical composition to see how it has changed over time. Here's what it looks like, for example:

I will explain the problem to you,

even when the analysis analyzes the previous composition of the portfolio for me, only the allocation percentages change, but the names of the assets do not change throughout the periods, and this is incomprehensible to me, because perhaps he should have diversified the assets over the years.

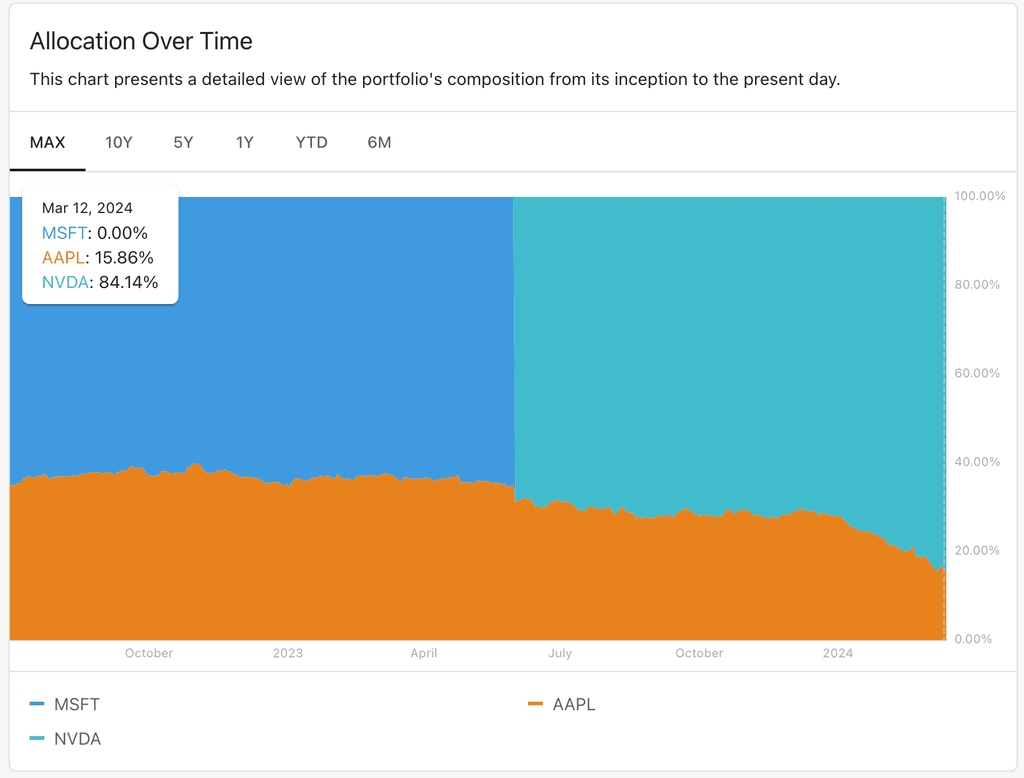

It depends on the portfolio type. What you're describing can be implemented with transactional portfolios. For instance, in the chart, MSFT was swapped for NVDA at some point, and the performance calculations reflect that.

However, not all portfolios are transactional. Static portfolios have many valid use cases, from simple backtesting to "lazy" portfolios that only get rebalanced periodically without changing the holdings.